‘You OK Boomer?’ Gold Sees Biggest Loss Since 2013 as Bitcoin Steadies

'You OK Boomer?' Gold Sees Biggest Loss Since 2013 as Bitcoin Steadies

Image courtesy of CoinTelegraph

Bitcoin (BTC) saw a difficult week as it hit one-month lows, but on gold markets, traders were nursing the biggest daily falls in over seven years.

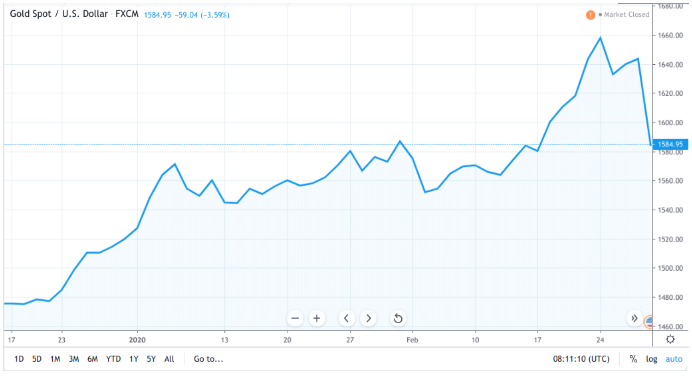

According to data tracking XAU/USD on Feb. 29, Friday saw the precious metal's worst 24-hour drop since 2013.

Gold drops 7% in 5 days after coronavirus sell-off

Over the past five days, gold broadly succumbed to the sell-offs affecting traditional markets due to the ongoing coronavirus outbreak. Between Feb. 24 and Feb. 29, XAU/USD lost a total of 7.3% before a slight rebound.

The fragile performance puts gold roughly on par with "digital gold," Bitcoin, the weekly losses for which currently stand at around 9%.

Gold year-to-date chart. Source: TradingView

As Cointelegraph reported, after rebounding from 4-week lows of $8,450, the largest cryptocurrency returned to its forecast average price and has since attempted to reclaim its 200-day moving average near $8,800.

While gold remained steadfast in a plummeting stock market, its proponents had cause for celebration. Gold bug and infamous Bitcoin skeptic, Peter Schiff, took the opportunity to rubbish those who believed BTC could act as a safe haven.

Schiff: gold "not invalidated"

Following the U-turn in its fortunes, Schiff remained convinced in gold's promise, while acknowledging such drops were "very rare."

"Today's 4% drop in gold is a very rare move in a single day. But it does happen occasionally," he wrote in a tweet on Friday.

"However a 4% drop in @Bitcoin is quite common, which often posts daily declines much larger. Today's move doesn't invalidate gold's safe haven or long-term store of value status."

Bitcoin figures, notably Schiff's sparring partner Morgan Creek Digital co-founder Anthony Pompliano, had wryly suggested that someone should "check on" him as gold's own health waned.

Stock market misery meanwhile continues after the Dow Jones suffered its own record-breaking daily loss on Wednesday. Traders have since overwhelmingly bet on the United States Federal Reserve cutting its short-term interest rate target significantly in 2020.

Original article posted on the CoinTelegraph.com site, by William Suberg.

Article re-posted on Markethive by Jeffrey Sloe

Visit MarketHive to learn more: http://markethive.com/jeffreysloe