One Catalyst Could Send Bitcoin Into the Stratosphere

This One Catalyst Could Send Bitcoin Into the Stratosphere, Says CryptoQuant CEO

By Daily Hodl Staff • May 12, 2021 // BITCOIN

CryptoQuant CEO Ki Young Ju is naming one catalyst that he says could send Bitcoin’s (BTC) value into the stratosphere.

In a new tweet, the CEO of the on-chain analysis firm tells his 165,00 followers that he believes the approval of a Bitcoin exchange traded fund (ETF) could act as a big catalyst to push Bitcoin’s price to greater heights.

“NYSE (New York Stock Exchange) listed the first gold ETF in Nov 2004, and the price never came back. Many economic factors have affected the gold price, but listing ETF would have played a major role in the inflow of global institutional funds. We may never see this BTC price again once ETF’s approved.”

Source: Ki/Twitter (Click image for larger view)

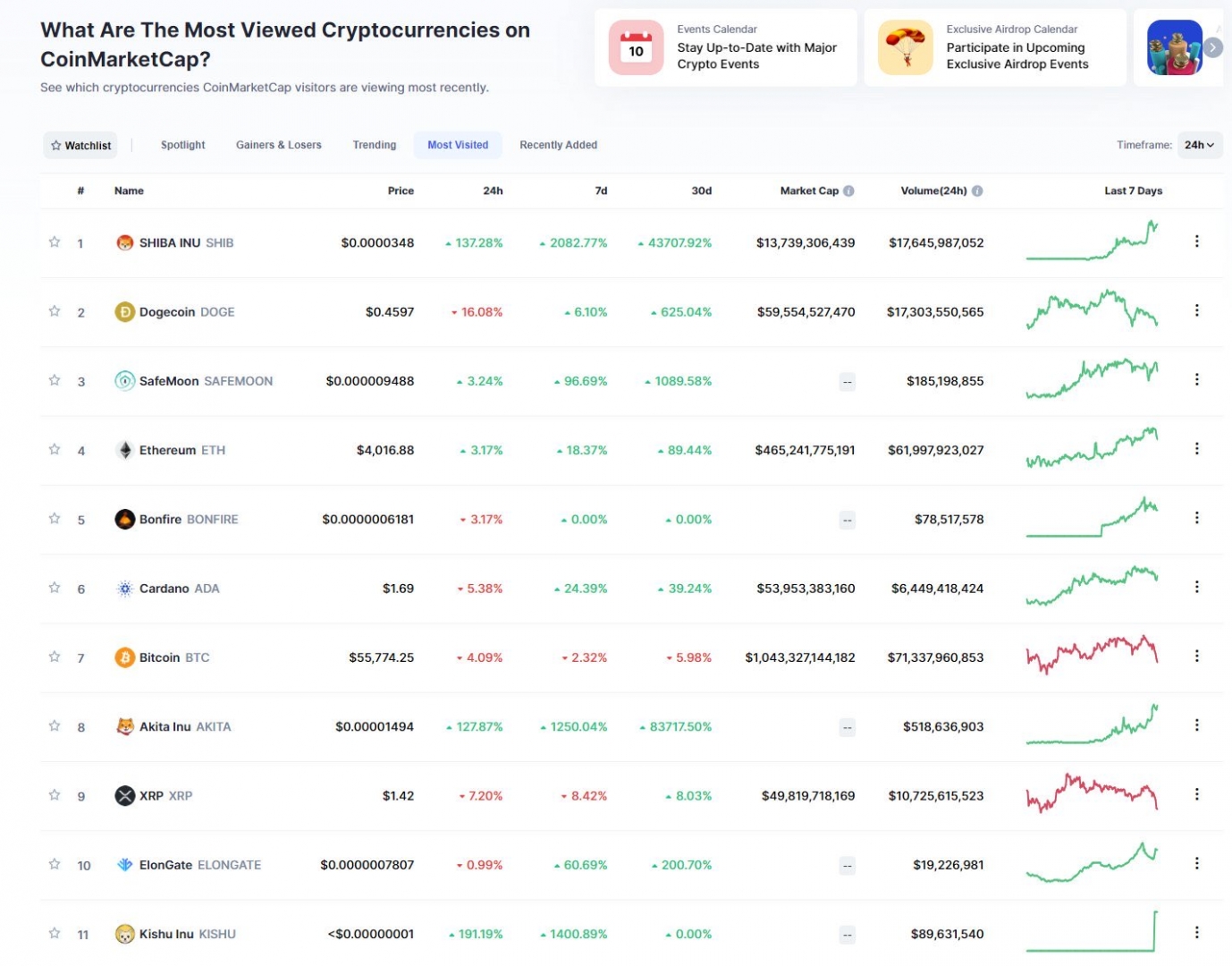

The CryptoQuant CEO implies that Bitcoin’s consolidation below $60,000 is largely driven by retail capital being allocated in memecoins and low-cap crypto assets such as Dogecoin (DOGE), Shiba Inu (SHIB), and SafeMoon.

“I think this is why the BTC price is going down in spite of strong fundamentals. The market will become smart money soon, and the funds will go to major coins that have intrinsic value.”

Source: Ki/Twitter (Click image for larger view)

Although Bitcoin continues to struggle to breach resistance at $60,000, Ki believes that the leading crypto asset remains bullish.

“This BTC correction is more like a technical correction, and the fundamentals are still strong. US institutional demand has driven this bull market. There’s no change in this trend…

We may see a series of announcements of BTC purchases from institutions like Facebook soon. Institutions have been accumulated BTC in the $48,000 – $60,000 range since February. Approximately, 154,000 Bitcoin have flowed out from Coinbase into multiple cold wallets.”

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/sdecoret

The original article written by Daily Hodl Staff and posted on DailyHodl.com.

Article reposted on Markethive by Jeffrey Sloe