Decreasing Ethereum Network Activity Foreshadowed ETH’s Pullback

Decreasing Ethereum Network Activity Foreshadowed ETH’s Pullback

John P. Njui • BITCOIN (BTC) NEWS • ETHEREUM (ETH) NEWS • SEPTEMBER 5, 2020

In summary:

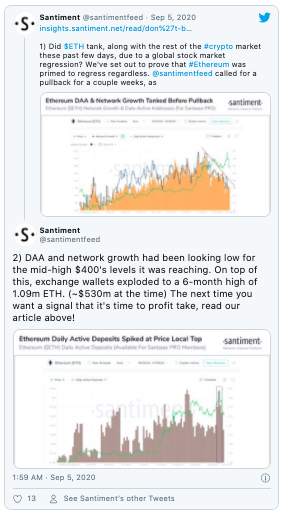

- Ethereum’s price had shown signs of weakness as daily active addresses and network growth had started fading

- Furthermore, exchange wallets exploded to a 6-month high signifying a possible top for ETH

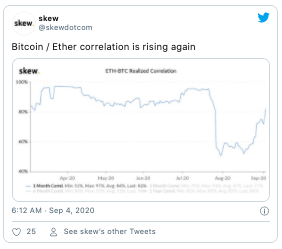

- Additionally, Ethereum’s correlation with Bitcoin has started to increase once again

Ethereum is once again below the crucial $365 support level. Ethereum’s troubles came after ETH rallied to a two year high of $490 on the 1st of September before following Bitcoin on a fast drop that started on the same day. ETH has continued on a downward spiral and has lost several support zones in the process. They include $450, $420, $400 and $365.

Ethereum Was Primed for a Pullback

According to the team at SantimentFeed, Ethereum was primed for a pullback based on declining daily active addresses and fading network growth. Furthermore, in the last week or so, ETH exchange wallets had increased to a 6-month high hinting of a possible top for Ethereum. The team at Santiment shared their observations of Ethereum via the following two tweets.

Ethereum’s Increased Correlation to Bitcoin Also Pointed Towards a Correction

Additionally, and before ETH’s dip from $490, Ethereum’s correlation to Bitcoin had begun to increase once again.

Initially, Ethereum looked set to break away from Bitcoin’s influence due to the increased DeFi activity on the Ethereum network. However, Bitcoin’s influence on the price of Ethereum is once again showing its full effects. The team at Skew has highlighted this occurrence in the following tweet and accompanying chart.

How Low Can Ethereum Go?

When it comes to predicting a possible bottom for Ethereum in the current market environment, not much can be predicted without checking what is going on with Bitcoin. If the King of Crypto continues on its downward spiral, Ethereum will go down with BTC.

If the $335 – $300 support zone fails, it is prudent to conclude that Ethereum will be headed back to the $290 price area.

As with all analyses of Ethereum, traders and investors are advised to use adequate stop losses when trading ETH on the various derivatives platforms.

Original article posted on the EthereumWorldNews.com site, by John P. Njui.

Article re-posted on Markethive by Jeffrey Sloe

Visit MarketHive to learn more: http://markethive.com/jeffreysloe