Cardano’s Surge in Investment Inflows

Why Cardano Has Seen a Surge in Investment Inflows Over Last Week

By Reynaldo Marquez – May 25, 2021 in Cardano Reading Time: 2min read

Cardano has fallen with the rest of the market but seems more resilient than other assets in the crypto top 10 by market cap. At the time of writing, ADA trades at $1.52 with a 2.8% profit in the daily chart and a 3.9% profit in the 1-hour chart. Over the past month, ADA also records an impressive 36.8% rally.

ADA with small gains in the daily chart. Source: ADAUSDT Tradingview

Bitcoin’s crash was triggered partially by environmental concerns. Expressed by Tesla’s CEO, Elon Musk, it appears to have influenced some investors. According to a report by CoinShares, Cardano-based investment products benefited from this narrative.

Last week, Cardano experienced its largest investment inflows with $10 million in response to “investors actively choosing proof of stake coins based on environmental considerations”, the report claims.

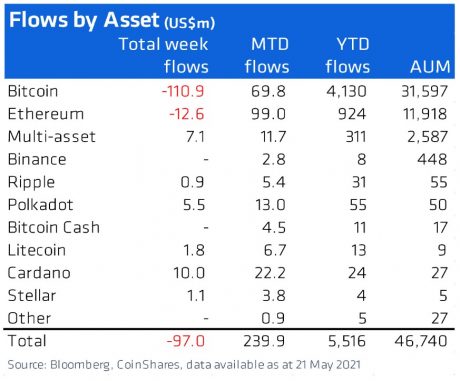

Other than BTC, altcoins saw positive inflows in the same period but generally, Asset Flows have been trending negative for the past two weeks, as shown in the chart below.

Ethereum saw outflows estimated at $12.6 million after a long period with record-high inflows. In 2021, Ethereum based investment products have seen a total of $924 million inflows, according to CoinShares.

Cardano Outperforms Bitcoin Weekly Investment Inflows

Bitcoin was the most impacted by negative asset outflows with 110.9 million. However, the first cryptocurrency by market cap still records $4,130 million in Year-to-Date (YTD) positive flows with 31,597 in assets under management (AUM).

Ripple, Polkadot, Litecoin, and Stellar also saw positive inflows, but only DOT comes close to ADA with $5.5 million. Cardano has the fifth position in YTD positive inflows with $24 million behind Bitcoin, Ethereum, Polkadot ($55 million), and Ripple ($31 million). The report claims the following:

Digital asset investment product saw net outflows for the second consecutive week totalling US$97m, another new record for outflows. (…) it represents a net change in sentiment following increasing regulatory scrutiny and concerns over Bitcoin’s environmental credentials.

This suggests a rise in the persistent bearish sentiment over the crypto market’s performance. Still, CoinShares’ outflow represents only 0.2% of their AUM. This sum is small when compared with the $5.5 billion received YTD.

As reported by newsBTC, Cardano was amongst the most resilient assets during last week’s correction. The debate over Bitcoin’s environmental footprint has extended to the advantages of Proof-of-Work versus Proof-of-Stake consensus algorithm.

Cardano’s inventor, Charles Hoskinson, weighted in and highlighted the benefits of PoS. Hoskinson said that this type of consensus is more energy-efficient and fits the environmental requirements expressed by Musk and others.

In a separate statement, Hoskinson informed the community of IOG’s busy schedule for the next 3 months. The company is preparing to implement Plutus, Cardano’s smart contract platform. Hoskinson said:

We are all gonna work together to get this done, and I hate delays. I hate setbacks, and we’ve done everything in our power to try to de-risk things…All that said, stuff could come up, and it’s important to manage expectations.

The original article was written by Reynaldo Marquez and posted on NewsBTC.com.

Article reposted on Markethive by Jeffrey Sloe

Visit MarketHive to learn more: http://markethive.com/jeffreysloe