Ethereum could see new ETH all-time high

Ethereum ‘liquidity crisis’ could see new ETH all-time high before Bitcoin — Analyst

It’s dog-eat-dog for the return to all-time highs between Bitcoin and Ether, the latest data suggests.

Image courtesy of CoinTelegraph

Ethereum‘s native token, Ether (ETH), may beat Bitcoin (BTC) to new all-time highs, fresh analysis reveals.

In a tweet on Wednesday, Ki Young Ju, CEO of on-chain analytics service CryptoQuant, highlighted a “sell-side liquidity crisis” that could yet give ETH the edge over BTC.

Ether liquidity shortfall “intensifying”

With Bitcoin up over 50% versus its lows of $29,000, altcoins have also begun to reawaken, with Ether as no exception.

The largest altcoin has recaptured $3,000, a level that, this week, is now in the process of being retested as support.

Despite attention focusing on Bitcoin reclaiming $50,000, optimism over Ether remains high after its successful London hard fork deployment earlier this month.

Thanks in part to the supply changes pushed through via the hard fork, a liquidity shortfall could ultimately serve to push ETH/USD to new historic peaks before BTC/USD manages to do the same.

“$ETH might reach its all-time high earlier than $BTC in the long term,” Ki summarized.

“Current $ETH price is closer to ATH compared to $BTC. Higher demand, lower supply. $ETH sell-side liquidity crisis still intensifies, while $BTC exchange reserve stopped its downward trend in May.”

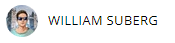

BTC exchange reserve chart. Source: CryptoQuant

In terms of numbers, Bitcoin exchange reserves have been declining since May, only to return in late July. From a peak of 2.54 million on July 26, BTC reserves then declined to 2.44 million this week.

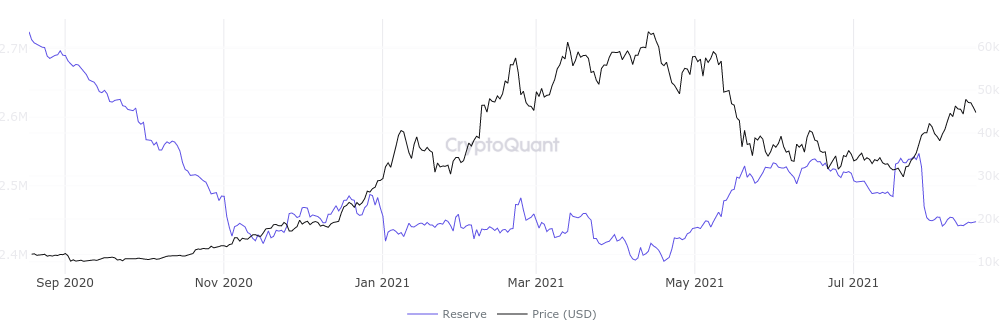

By contrast, ETH has seen a mostly linear downtrend since late May’s local high of 21.43 million held on exchanges. As of this week, the exchange balance is around 19.25 million.

ETH exchange reserve chart. Source: CryptoQuant

Battle of the supply shocks

Ki is not alone in forecasting a more rampant bull charge for Ether compared to Bitcoin.

Related: Analysts say this key metric suggests an altcoin season is at hand

As Cointelegraph reported, Bloomberg Intelligence has also come out favoring ETH over BTC in a recent report, even forecasting a “flippening” of the largest cryptocurrency.

Meanwhile, data continues to show a supply shock underway for Bitcoin as well — something that has its own historical precedent for sparking BTC price run-ups.

“Illiquid Supply Shock ratio has been a good leading indicator over the past few months,” analyst William Clemente III commented on the latest figures from fellow on-chain analytics resource Glassnode.

“Impulses in both directions have resulted in price action following. As the metric continues to grind slowly upward, currently at levels prev. 58K BTC, watching for another major impulse.”

Bitcoin supply shock annotated chart. Source: William Clemente III/Twitter

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of Cointelegraph.com. Every investment and trading move involves risk, you should conduct your own research when making a decision.

Original article posted on the CoinTelegraph.com site, by William Suberg.

Article re-posted on Markethive by Jeffrey Sloe